An organization continually rewarding at the net profits line could in reality still be within a very poor money state and in many cases go bankrupt.

Luckily, the rules are easy to comprehend. You make improvements to cash flow by both raising your cash flow or lowering your costs – or both. You damage cash move by carrying out the other.

Though accrual accounting has become the standardized technique of bookkeeping per GAAP reporting specifications inside the U.S., it remains an imperfect process with quite a few constraints.

Particularly, the net money metric identified over the cash flow statement could be deceptive for measuring the movement of an organization’s actual cash flows.

You then’ll subtract the price of purchasing any long-expression property including products or securities. These totals would then be described on your company cash movement statement.

Specific Marketable Securities. This wide term handles any expense stability that can quickly be converted to cash in a short amount of time. Many of the examples under can be referred to as marketable safety, and corporations frequently lump these investments collectively on their own balance sheet.

The cash move assertion is a fiscal statement that studies a company's resources and utilization of cash over time.

Financial gain refers back to the amount left about after subtracting costs from revenues; cash stream may be the amount of cash flowing out and in of a business.

An organization's cash ratio is usually regarded as much too substantial. A corporation could be inefficient in running cash and leveraging low credit score terms. It could be advantageous for an organization to lessen its cash ratio in these scenarios.

We imagine Absolutely everyone must be capable of check here make monetary conclusions with self confidence. And when our web-site doesn’t characteristic each enterprise or fiscal solution available that you can buy, we’re very pleased that the direction we provide, the information we provide and the equipment we make are goal, impartial, uncomplicated — and free.

Cash: Definition, Differing types, and Historical past Cash is lawful tender or cash which can be used to Trade merchandise, financial debt, or providers. Cash in its Actual physical variety is The only, most broadly acknowledged and reliable sort of payment.

Constraints of your Cash Ratio The cash ratio is rarely Employed in economical reporting or by analysts in the elemental Evaluation of a company. It's actually not sensible for an organization to keep up extreme amounts of cash and around-cash assets to include present liabilities.

But for 12 months one, the retained earnings equilibrium is equivalent to the prior year’s harmony plus net earnings.

Conceptually, The web cash move equation consists of subtracting a company’s total cash outflows from its total cash inflows.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Alicia Silverstone Then & Now!

Alicia Silverstone Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Nancy Kerrigan Then & Now!

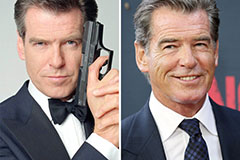

Nancy Kerrigan Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!